For Ga Medicaid What Does Modifier Requires Review Prior to Payment Denial Mean

CMS Guidance: Reporting Denied Claims and Run into Records to T-MSIS

Guidance History

| Engagement | Description of Change |

|---|---|

| 3/13/2020 | Original guidance issued |

| 5/28/2020 | Language added to clarify the compliance date to cease reporting to TYPE-OF-CLAIM value "Z" as June 2021 |

Brief Issue Description

Multiple states are unclear what constitutes a denied merits or a denied encounter record and how these transactions should be reported on T-MSIS merits files.

Groundwork Discussion

Context

Reason Why CMS Wants States to Submit Denied Claims and Encounters

CMS needs denied claims and encounter records to support CMS' efforts to combat Medicaid provider fraud, waste and abuse. The data are also needed to compute certain Healthcare Effectiveness Data and Data Fix (HEDIS) measures. If a claim was submitted for a given medical service, a record of that service should exist preserved in T-MSIS. It does non matter if the resulting claim or encounter was paid or denied.

For additional groundwork, readers may desire to review Appendix P.01: Submitting Adjustment Claims to T-MSIS in the T-MSIS Data Dictionary, version two.3.

Definitions

FFS Claim – An invoice for services or appurtenances rendered past a provider or supplier to a beneficiary and presented past the provider, supplier, or his/her/its representative directly to the state (or an administrative services only claims processing vendor) for reimbursement because the service is non (or is at least not known at the fourth dimension to be) covered under a managed intendance system under the authority of 42 CFR 438.

Managed Intendance Encounter Merits – A merits that was covered under a managed care arrangement under the dominance of 42 CFR 438 and therefore not paid on a fee-for-service basis directly by the state (or an authoritative services only claims processing vendor). Encounter records often (though not always) brainstorm as fee-for-service claims paid by a managed care organization or subcontractor, which are then repackaged and submitted to the state equally run into records.

Adjudication – The procedure of determining if a merits should be paid based on the services rendered, the patient's covered benefits, and the provider's authority to render the services. Claims for which the adjudication process has been temporarily put on hold (e.g., awaiting additional data, correction) are considered "suspended" and, therefore, are not "fully adjudicated."1

Denied FFS Claim two – A claim that has been fully adjudicated and for which the payer entity has determined that it is not responsible for making payment because the claim (or service on the claim) did non come across coverage criteria. Examples of why a claim might be denied:

- Services are non-covered

- Beneficiary'southward coverage was terminated prior to the date of service

- The patient is not a Medicaid/CHIP beneficiaryiii

- Services or goods have been adamant not to exist medically necessary

- Referral was required, but there is no referral on file

- Required prior authorization or precertification was not obtained

- Claim filing deadline missed

- Invalid provider (eastward.k., not authorized to provide the services rendered, sanctioned provider)

- Provider failed to answer to requests for supporting information (eastward.g., medical records)

- Missing or Invalid Service Codes (CPT, HCPCS, Revenue Codes, etc.) which have not been provided after the payer has made a follow-up request for the data

The complete listing of codes for reporting the reasons for denials can be found in the X12 Claim Adjustment Reason Lawmaking set, referenced in the in the Health Care Claim Payment/Advice (835) Consolidated Guide, and available from the Washington Publishing Company.

Denied Managed Care Encounter Claim – An see merits that documents the services or appurtenances actually rendered by the provider/supplier to the beneficiary, just for which the managed intendance program or a sub-contracted entity responsible for reimbursing the provider/supplier has determined that information technology has no payment responsibleness.

Challenges

Contractual Scenarios and Their Impacts on the Creation of Denied Merits or Encounter Records

The contractual relationships amid the parties in a state'due south Medicaid/CHIP healthcare system'south service delivery chain tin can be complex. For example, the Medicaid/CHIP bureau may cull to build and administer its provider network itself through simple fee-for-service contractual arrangements. In such an arrangement, the agency evaluates each claim and determines the appropriateness of all aspects of the patient/provider interaction. Alternatively, the Medicaid/CHIP bureau may choose to contract with one or more than managed intendance organizations (MCOs) to manage the care of its beneficiaries and administer the delivery-of and payments-for rendered services and appurtenances. The agency may contract with the prime MCO on a capitated footing, just then the MCO might choose to build its provider network by: subcontracting with other MCOs on a FFS basis or capitated basis, subcontracting with individual providers on a FFS basis or capitated basis, and/or with another arrangements. Additionally, the construction of the service delivery chain is not limited to a two- or three-level hierarchy.

While the pay/deny decision is initially made by the payer with whom the provider has a direct provider/payer relationship, and the initial payer'southward decision will mostly remain unchanged as the encounter record moves upward the service delivery chain, the entity at every layer has an opportunity to evaluate the utilization tape and make up one's mind on the appropriateness of the underlying casher/provider interaction. Whenever information technology concludes that the interaction was inappropriate, it can deny the claim or meet record in part or in its entirety and push the transaction back down the bureaucracy to exist re-adjudicated (or voided and re-billed to a non-Medicaid/CHIP payer). At each level, the responding entity tin attempt to recoup its cost if information technology chooses. If the recoupment takes the form of a re-adjudicated, adapted FFS merits, the adjusted claim transaction will flow back through the hierarchy and exist associated with the original transaction. If the denial results in the rendering provider (or his/her/its amanuensis) choosing to pursue a non-Medicaid/CHIP payer, the provider will void the original claim/run across submitted to Medicaid.

The complexity of reporting attempted recoupments4 becomes greater if there are subcapitation arrangements to which the Medicaid/Flake agency is non a direct party. If the agency is the recipient of recouped funds, a T-MSIS financial transaction would be used to report the receipt. If the agency is non the recipient, at that place is no monetary touch on to the agency and, therefore, no demand to generate a fiscal transaction for T-MSIS.

Regardless of the number of levels of subcontracts in the service delivery chain, it is not necessary for the state to report the pay/deny decision made at each level. The state should report the pay/deny determination passed to it past the prime number MCO. This process is illustrated in Diagrams A & B.

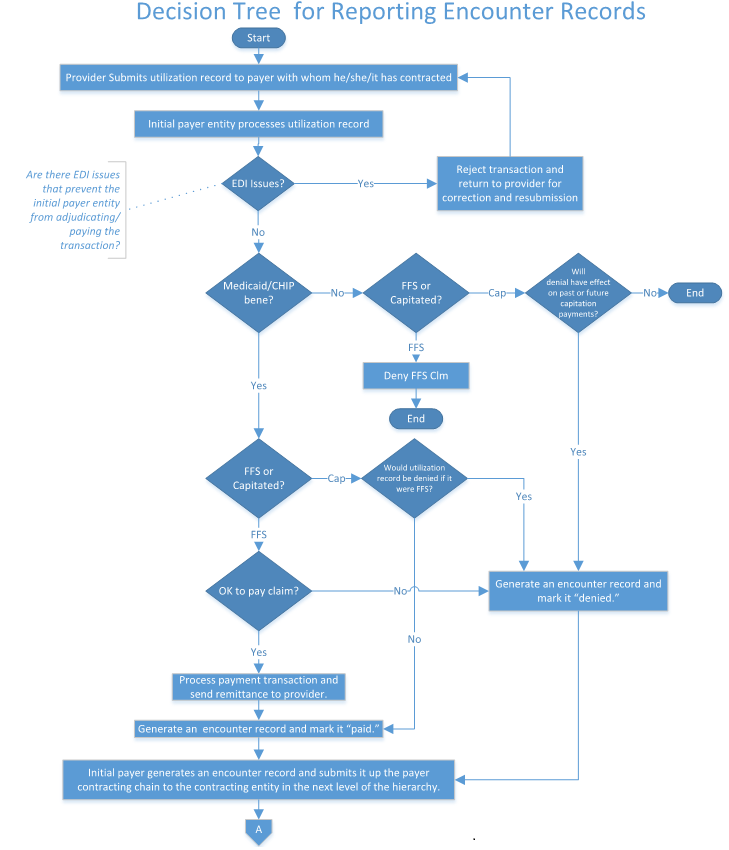

Diagram A: Decision Tree for Reporting Managed Care Encounter Claims – Provider/Initial Payer Interactions

Diagram B: Decision Tree for Reporting Meet Records – Interactions Among the MCOs Comprising the Service Delivery Hierarchy

CMS Guidance

- All claims or encounters that complete the adjudication/payment process should be reported to T-MSIS. This is true even if the managed care organization paid for services that should non take been covered by Medicaid. Come across Diagram C for the T-MSIS reporting decision tree.

- Suspended claims (i.e., claims where the arbitrament process has been temporarily put on hold) should not exist reported in T-MSIS. Additionally, claims that were rejected prior to beginning the adjudication process because they failed to run across bones merits processing standards should non be reported in T-MSIS. NOTE: Transactions that fail to procedure because they do not meet the payer's data standards correspond utilization that needs to be reported to T-MSIS, and every bit such, the issues preventing these transactions from being fully adjudicated/paid need to be corrected and re-submitted.

- All denials (except for the scenario called out in CMS guidance detail # ane) must be communicated to the Medicaid/Scrap agency, regardless of the denying entity's level in the healthcare system'due south service commitment chain. It volition not exist necessary, however, for the country to identify the specific MCO entity and its level in the delivery concatenation when reporting denied claims/encounters to T-MSIS. Just reporting that the encounter was denied will exist sufficient.

- Voids and Adjustments of previously denied claims or encounter records must be communicated to the Medicaid/CHIP agency (except for the scenario called out in CMS guidance item # 1), so that the Medicaid/Flake agency can include the information in its T-MSIS files.

- The Medicaid/Fleck agency must study changes in the costs related to previously denied claims or encounter records whenever they straight affect the price of the Medicaid/Bit program. Depending on the nature of the payment arrangements among the entities of the Medicaid/CHIP healthcare system's service supply concatenation, these may take the form of voided claims (or encounters), adapted claims (or encounters), or financial transactions in the T-MSIS files.

- Whenever an entity denies a merits or encounter tape, it must communicate the appropriate reason code upwardly the service commitment chain.

- The Medicaid/CHIP agency must include the claim adjustment reason lawmaking that documents why the claim/encounter is denied, regardless of what entity in the Medicaid/CHIP healthcare arrangement's service supply concatenation made the decision. This code should be reported in the ADJUSTMENT-REASON-Code data element on the T-MSIS claim file.

- To the extent that it is the state'due south policy to consider a person "in spenddown manner" to exist a Medicaid/Chip beneficiary, claims and come across records for the casher must be reported T-MSIS.

- Instructions for Populating Data Elements Related to Denied Claims or Denied Merits Lines.

States' MMIS systems may flag denied claims (or denied claim lines) differently from one another. Regardless of how a country identifies denied claims or denied claim lines in its internal systems, the state should follow the guidelines below to place denied claims or denied claim lines in its T-MSIS files.CLAIM-DENIED-INDICATOR – If the entire merits is denied, the CLAIM-DENIED-INDICATOR should exist set to "0". If some, but not all, of the lines on the claim transaction are denied, the Claim-DENIED-INDICATOR should be prepare to "one". If none of the lines on the claim transaction are denied, the Claim-DENIED-INDICATOR should exist set to "1". The CLAIM-DENIED-INDICATOR set to "0" is the way that T-MSIS data users volition identify completely denied merits transactions.

Merits-LINE-Status – If a particular detail line on a merits transaction is denied, its Claim-LINE-Status code should be one of the following values: "542", "585", or "654". Any other value volition be interpreted as indicating a paid line. If all of the lines on a claim transaction are denied, and so the Merits-DENIED-INDICATOR should be set to "0", rather than setting each line's CLAIM-LINE-STATUS to one of the denied code values ("542", "585", or "654").

CLAIM-Condition – Logically speaking, if the Claim-DENIED-INDICATOR equals "0" (the entire claim is denied), one would expect the Merits-STATUS code data element to equal one of the following values: "542" (Claim Total Denied Accuse Amount), "585" (Denied Charge or Non-covered Charge), or "654" (Total Denied Accuse Amount).

An inconsistency between the CLAIM-DENIED-INDICATOR value and the CLAIM-Status value will trigger a validation edit error.

Please note, however, that T-MSIS data users will use CLAIM-DENIED-INDICATOR equals "0" to place a completely denied claim transaction, regardless of the CLAIM-Condition value reported on the merits transaction's header tape.Merits-STATUS-CATEGORY – Logically speaking, if the Merits-DENIED-INDICATOR equals "0" (the entire claim is denied), one would await the Merits-STATUS-CATEGORY value to equal "F2" (Finalized/Deprival-The claim/line has been denied).

An inconsistency between the Merits-DENIED-INDICATOR value and the CLAIM-STATUS-CATEGORY value will trigger a validation edit error.

Every bit is the example with Merits-Condition, however, T-MSIS data users will use CLAIM-DENIED-INDICATOR equals "0" to identify a completely denied claim transaction, regardless of the Claim-Status-CATEGORY value reported on the claim transaction's header record.Type-OF-Merits – Blazon-OF-CLAIM value "Z" should not be used.

Use of the Type-OF-CLAIM value "Z" will trigger a validation edit fault.

States volition exist required to stop reporting to value "Z" by June 2021. Later on that indicate, whatever files not corrected may be required to be resubmitted.

The Type-OF-CLAIM lawmaking should be the code that would accept been used if the claims were paid.

[1] Suspended claims are not synonymous with denied claims. The responsibleness-for-payment decision has non yet been made with regard to suspended claims, whereas it has been made on denied claims. Suspended claims should non be reported to T-MSIS. NOTE: Paid encounters that do not meet the state'south information standards correspond utilization that needs to be reported to T-MSIS. EDI issues preventing these transactions from being fully adjudicated/paid need to be corrected and re-submitted to the Payer.

[2] A denied merits and a zero-dollar-paid claim are not the aforementioned matter. While both would have $0.00 Medicaid Paid Amounts, a denied claim is one where the payer is non responsible for making payment, whereas a zero-dollar-paid claim is ane where the payer has responsibleness for payment, only for which information technology has determined that no payment is warranted. (Examples include: previous overpayments commencement the liability; COB rules issue in no liability.)

[3] If the payer entity determines during the adjudication process that information technology has no payment responsibility considering the patient is non a Medicaid/Scrap beneficiary, it is not necessary for the country to submit the denied claim to T-MSIS. However, if the payer initially makes payment and then later determines that the beneficiary is not a Medicaid/CHIP beneficiary, then CMS expects the merits to exist reported to T-MSIS (as well as any subsequent recoupments). (See footnote #4 for a definition of "recoupment.")

[iv]"Recoupment" means:

- Recoveries of overpayments made on claims or encounters.

- TPL recoveries that start expenditures for claims or encounters for which the state has, or will, request Federal reimbursement nether Title XIX or Title XXI.

- Rebates that starting time expenditures for claims or encounters for which the state has, or will, asking Federal reimbursement under Title XIX or Title XXI.

Collection

T-MSIS Coding Blog

Render TO T-MSIS CODING BLOG

Collections: T-MSIS Coding Blog

Source: https://www.medicaid.gov/medicaid/data-and-systems/macbis/tmsis/tmsis-blog/entry/53973

0 Response to "For Ga Medicaid What Does Modifier Requires Review Prior to Payment Denial Mean"

Post a Comment